Content

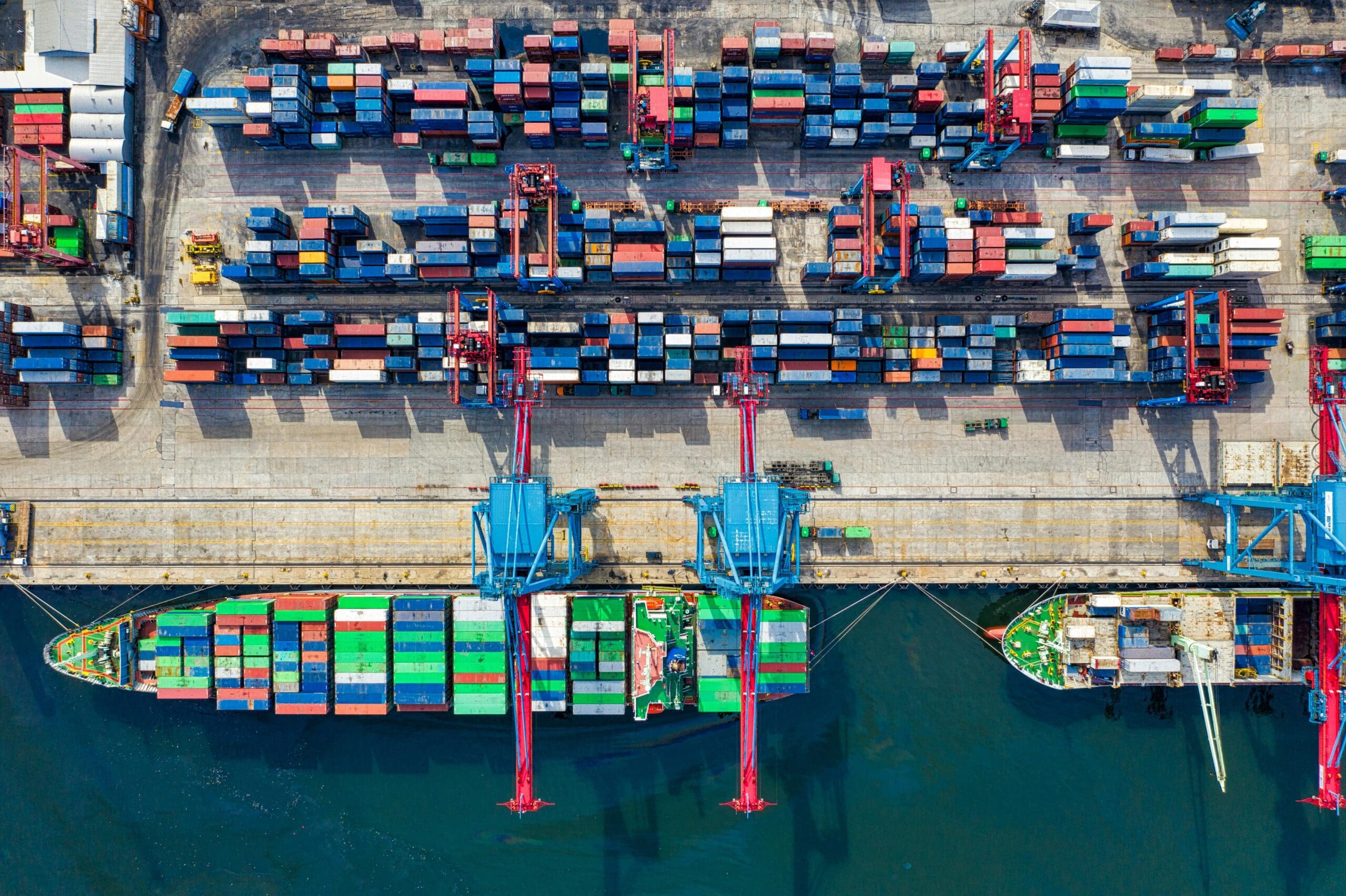

expand_moreDoes it seem like most products you buy are made in China? According to the 2021 Global Imports Report, most probably are. China is the leading maritime importer for the United States by an impressive margin, accounting for 42% of all goods shipped to the U.S.

It not only sends far more products in general to the U.S. than any other country, it also leads every category of imported goods, from textiles to plastics to metals and beyond. China increases the volume of goods it sends to the U.S. nearly every year by hundreds of thousands of units.

Let’s dive into the data on U.S. imports from China to see what has changed over the years, identify the kinds of products China ships to the U.S., and project how China’s trade numbers will evolve in the future.

China’s global trade performance from 2015 – 2021

As of June 2021, China accounts for about 42% of U.S. maritime imports, which equates to 3,139,939 shipments. It leads all other countries in total share of U.S. imports, as well as shares of every U.S. import product category.

China has historically led the field, maintaining roughly two-fifths of the U.S. imports share for at least the past six years — even as other global leaders ramp up their overseas trading.

China’s roughly 1% growth in the share of U.S. imports over the past six years isn’t as large as Vietnam’s 14% increase or India’s 32% increase. But it still leads the U.S.’s next-largest importer (Vietnam) by 35 percentage points in terms of its claim on total U.S. imports.

The impact of COVID-19 on U.S. imports from China

Long-term growth and dominance aside, China experienced difficulties maintaining supply chains in early 2020, which impacted its contribution to U.S. imports. China encountered the novel coronavirus first and experienced its initial spike in cases and deaths in January of 2020, weeks before these metrics peaked in neighboring countries, Europe, and the Americas. As China took strong measures to curb the spread of COVID-19 within its borders, its imports to the U.S. dropped dramatically.

By April 2020, China regained positive year-over-year growth in its share of U.S. imports. On the whole, China’s share of U.S. imports fell slightly over the past year, while other major U.S. importers — Vietnam, India, and Italy — gained share.

Putting the share of total imports aside, China dramatically increased the volume of products it ships to the U.S. over the past two years. Already, U.S. seaports have received 3,139,939 Chinese imports as of June — a difference of over 800,000 since last year.

This growth trend is historical, with one notable dip in the past several years: in 2019, the inflamed Chinese-American trade relationship sent Chinese imports plummeting 9% year over year, after steady growth since 2015.

Given the consumer-driven rise in demand for goods during the COVID-19 pandemic, a rebound was imminent. After serious interruptions in China’s manufacturing and overseas shipping systems in early 2020, the U.S. ended the year with 23% more goods from China than in 2019.

That’s not to say it was all smooth sailing for the ecommerce businesses dependent on China’s manufactured goods during the pandemic. As many as 36% of Amazon sellers surveyed by Jungle Scout in December of 2020 experienced difficulties getting new inventory stateside, citing soaring freight costs and weeks of delivery days due to congested ports. Additionally, two in five (44%) sellers say they ran out of stock because of COVID-19.

This year’s growth is a bright spot for sellers who struggled with inventory replenishment in the early months of the pandemic: U.S. imports from China from January-June 2021 are up 35% over the same period in 2020.

What kinds of products does the U.S. import from China?

China is the leading supplier for every import category for the United States. Its top import product categories track with those of the U.S. overall:

- Machinery & Electrical: 24% of U.S. imports from China

- Miscellaneous: 19%

- Metals: 10%

- Textiles: 8%

- Plastics/Rubbers: 7%

From January to June 2021, China’s top three categories made up a combined 53% of its U.S.-bound shipments. Machinery & Electrical, Miscellaneous, and Metals include a vast range of products, not all of which are consumer-friendly. But many recognizable brands source imported household essentials within these categories—like blenders, candles, and aluminum foil — from Chinese manufacturers. Using Jungle Scout’s Supplier Database, we can see which of these top retailers source products in China to sell on Amazon.

With that, let’s highlight a few of the big brands that currently sell products on Amazon sourced from Chinese suppliers, by top U.S. import categories.

Machinery & Electrical

The Machinery & Electrical category encompasses many common household devices. Think laser printers, countertop juicers, and those feline-friendly go-karts otherwise known as Roomba vacuum cleaners. In the first half of 2021, machines and electrical products made up roughly 20% of all U.S. imports and 24% of its imports from China.

Kitchenaid is a well-loved American brand within this category. Perhaps most famous for its lacquered stand-up mixers (and their various fancy attachments for apple-peeling and zoodling), it sells many other small appliances, kitchen gadgets, and cooking tools.

It’s owned by the Whirlpool Corporation, which sources products from a few different suppliers located in the Chinese cities of Suzhou, Qingdao, and Foshan.

One of Kitchenaid’s closest competitors is Cuisinart.

Owned by the Conair Corporation, it sources products from a supplier located in Shenzhen.

Miscellaneous

Miscellaneous imports make up an eclectic bunch: musical instruments, furniture, and timepieces, for example, fall within this broad category. In 2021, Miscellaneous imports accounted for about 15% of total U.S. imports, and 19% of goods imported to the U.S. from China.

A classic Timex wristwatch represents a mosaic of global production.

In addition to suppliers in the Philippines and the Netherlands, Timex Group sources parts from Yfy Jupiter Limited in Shenzhen.

Toys and games are other popular Amazon items categorized as Miscellaneous imports. Products sold by toy giant Mattel, including Barbie dolls and Baby Yoda figurines, are sourced from the Chinese cities of Dongguan and Guanyao.

Metals

Household staples like garden tools, combination locks, and filing cabinets all fall under the Metals import category. Roughly 9% of the U.S.’s total imports for 2021 are Metals. One in ten imports from China falls into this category.

That includes safes, lockboxes, and locks by American Security Products Company, or AMSEC. These products are made in Ningbo by the Ningbo Lockone International Company.

Keep in mind that the U.S. also imports more products in each category from China than any other country. You’ll find many more top brands on Amazon selling Chinese-made products like toilet paper, bicycles, and shoes.

Predicting the future of U.S. imports from China

As of June 30, 2021, U.S. seaports have received 7,570,327 shipments of goods from around the world. At this rate, it is set to reach 15.1 million imports by the end of the year — a 12.9% increase over 2020. With China accounting for 42% of the total, we can expect 6.3 million shipments of goods from China to arrive at U.S. ports by December 31, 2021.

The U.S. typically receives 6% more imports in the second half of the year (July – December). If that trend holds in 2021 and total U.S. imports reach 16 million, we can expect around 6.6 million shipments from China.

In any case, it’s likely that China will continue to lead U.S. imports in every category for the foreseeable future, given China’s strength in manufacturing and rising consumer demand for products in the U.S.

For more on China’s trade with the U.S., check out our 2021 Global Imports Report.

Molly is a writer on the Jungle Scout team, focusing on research and data-driven content. Before joining Jungle Scout in 2020, Molly was a food blogger and recipe developer. Her background is in nutrition and public health policy.