If you’re an Amazon seller living in the U.S., then you’re probably aware that tax time is coming up. Businesses such as partnerships, S corporations, or LLCs that are taxed as partnerships are required to file taxes by March 15, 2024. And individuals, C corporations, sole proprietors, single-member LLCs or LLCs taxed as corporations are due by April 15, 2024.

(You can make sure you don’t forget these extremely important dates each year by downloading our Amazon Seller Holiday Calendar.)

Since taxes can be a bit of a mystery for many, we’ve compiled some information to help navigate the tax waters, so to speak.

Should I get an accountant to file Amazon seller taxes?

Yes. Unless you’re a tax expert (ie. you’re already a certified public accountant), getting a professional accountant to handle your taxes is one of the best things you can do for your business.

And while there is a cost associated with having an accountant, a good accountant can save you money in taxes. They could even turn taxes owed into a tax refund.

What is a 1099-K form?

A 1099-K form is a sales reporting form issued by Amazon, and similar businesses. It provides the IRS with annual and monthly gross sales information, and includes sales tax and shipping fees.

If you’re an individual or professional Amazon seller, don’t worry. You don’t have to fill out this document; Amazon does it for you. They even send it to both you and the IRS, as long you meet the requirements.

Who gets a 1099-K form on Amazon?

Not every Amazon seller gets a 1099-K form from Amazon.

To meet the requirements for a 1099-K, you must have both $20,000 in total sales, and 200 individual transactions.

However, if you have at least 50 transactions, you still need to provide your tax status to Amazon. If you don’t, you risk losing your ability to sell on the platform.

You can provide Amazon with your tax information via your Seller Central account, under ‘tax information.’

Where can I find my 1099-K form?

If you’re an active seller on Amazon, and you meet the 1099-K qualifications, chances are Amazon has emailed you already. But, if you haven’t heard from them about your 1099-K, you can find the form by following these simple steps:

- First, login to your Amazon Seller Central account.

- Next, click on the Reports menu.

- From there, select the Tax Document library.

- And finally, download/print your 1099-K for the year.

What if my 1099-K form is inaccurate or I didn’t receive one?

Amazon is a multibillion-dollar Goliath, but even they make occasional mistakes. If Amazon didn’t issue you a 1099-K form, contact Seller support.

And if you see mistakes on your tax form, you can correct them by following these instructions:

- First, make sure you’re reporting the unadjusted total gross sales for the entire year. These are based on a product’s shipping date though, rather than the sale date. Therefore, if you made a sale on December 31, 2023, but it didn’t ship until January, it won’t be on the report.

- Then, print a date range report. Just follow these directions:

- Go to Seller Central and click the ‘Reports’ tab.

- Next, select ‘Date Range Reports.’

- Now, click ‘Generate a statement.’

- In the ‘Generate Date Range Report‘ popup, do the following:

- Select report type: ‘Summary.’

- Select reporting range: ‘Monthly’ or ‘Custom,’ and the specified date information.

- Click ‘Generate.’

- Once the report is generated (it can take up to an hour), review the report in the list on the Date Range Report.

- Calculate your unadjusted gross sales by adding the amounts in the report columns together; they’re listed in the two charts.

Do I need a business license to be an Amazon FBA seller?

No! Unless your state requires you to have one, you don’t have to have a business license to sell on Amazon.

Of course, if you have a larger Amazon business, with employees, offices, and other big-time expenses, it’s probably a good idea to get one.

Many sellers incorporate as Limited Liability Companies (LLC), as not only will a Limited Liability Company (LLC) designation protect you from having to take any personal responsibility for issues your business might run into, but it’s also great for tax purposes.

With an LLC, you can write off many of your business expenses through deductibles.

Do I have to file a schedule C (form 1040) if I have a business license?

If you operate as a business in your state, you need to file Schedule C, or form 1040.

If you go this route but don’t want to hire an accountant, then I strongly recommend using a bookkeeping software like Intuit Quickbooks. It will help you keep track of your expenses over the course of the year.

What is sales tax?

In the United States, sales tax is a tax levied on products considered to be non-essential. And sales tax varies from state to state.

For this reason, keeping track of sales tax when you’re selling in multiple states is difficult. Just another reason to get an accountant to help you with your books.

What is a sales tax nexus?

Like many things in the U.S., each state has its own definition of a sales tax nexus. But, in general, the definition of ‘sales tax nexus‘ is the place where your business has a physical presence.

For example, if you have an office in Oklahoma, but some of your inventory is in California, your sales tax nexus is both California and Oklahoma. In other words, you would have to collect sales tax in both states.

Important note: “Amazon calculates, collects, and remits tax on sales made by merchants shipped to customers located in the states that have enacted Marketplace Facilitator, Marketplace Fairness, or similar laws. These laws shift collection responsibility from the merchant to the marketplace facilitating the merchant’s sale. For more information, go to Marketplace Tax Collection.”

Please contact an accountant to determine if you still need to collect and remit sales tax in the state where your business is located.

When do I need to file sales tax?

In order to collect sales tax in the U.S., you need to apply for a sales tax permit. Then, once the state reviews your application, they will instruct you when to file. Typically, the government will tell you to file monthly, quarterly, or annually.

Make sure to pay attention to the due dates they give you though! Failure to file on time can result in the termination of your sales tax permit.

What’s a deductible?

A deductible is a business expense that you can write off.

By subtracting those costs from your adjusted gross income, you are helping to lower the amount of taxes you might have to pay.

Deductibles can save you money on both your business and personal taxes.

What’s tax-deductible for Amazon sellers?

Here is a list of some of the things you can write off as deductibles for your Amazon-selling business:

- Cost of goods sold (e.g. wholesale price, cost of manufacturing, etc.)

- Shipping costs, including fees and supplies

- Home office costs (e.g. electronics, furniture, office supplies, etc.)

- Amazon fees

- Mileage

- Donations (e.g. damaged goods donated to charity)

- Subscriptions

- Education pertaining to online business and e-commerce

- Software for taxes and inventory, including all of Jungle Scout’s software

- Online advertising (e.g. ads, business cards, print materials, etc.)

- Employee salary and benefits

- Consultant fees (e.g. accountant, lawyer, web designer, copywriter, etc.)

Make tax day easier with Jungle Scout

To prepare yourself better for tax day as an Amazon seller, you should utilize a tool that automatically and accurately organizes and tracks your Amazon sales data, product costs, and business expenses.

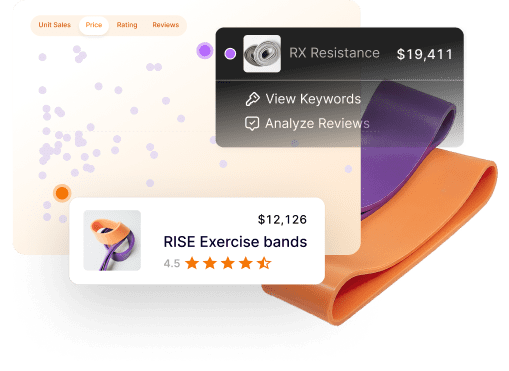

Jungle Scout’s Sales Analytics tool acts as a financial command center for your Amazon business and allows you to create a professional profit and loss statement to fully understand the financial health of your Amazon business.

With Sales Analytics, you can view important metrics such as net profit margin, units sold, ROI, total revenue, PPC costs, Amazon fees, and much more. Having all of this data in one place makes filing your taxes that much easier.

How will you file Amazon seller taxes?

Hopefully this article has helped shed some light on the things you need to know in order to file taxes for your Amazon FBA business correctly.

Good luck, and happy selling!

Learn more about Jungle Scout

Click the button below to learn more about Jungle Scout, including how to make tax day easier for your Amazon business!

Brian Connolly is an Amazon seller, ecommerce expert, and writer for Jungle Scout. He lives in the New Jersey Shore area with his wife and cat. When he isn’t writing advice online for aspiring and experienced Amazon sellers for Jungle Scout, he spends his free time boating, fishing, and selling boating-themed items on his Amazon business.